61+ how to get rid of fha mortgage insurance without refinancing

Web To remove PMI or private mortgage insurance you must have at least 20 percent equity in the home. Refinance to get rid of PMI.

How To Remove Pmi Get Rid Of Conventional Pmi Or Fha Mip Moreira Team Mortgage

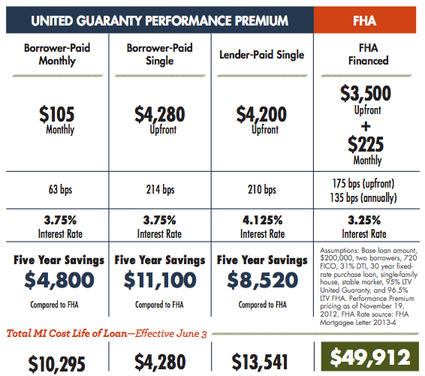

Web Things are a bit more complicated if you have an FHA loan as FHA mortgage insurance premiums are harder to drop.

. Ad Looking For a Mortgage Refinance. Web If you made a down payment of 10 or more on most recent FHA loans you may be able to cancel the MIP payments after 11 years. Check Out Our Rates Comparison Chart Before You Decide.

If interest rates have dropped since you took out the mortgage then you might consider refinancing to save money. To get rid of FHA mortgage. See If You Qualify Today.

Web How to Remove MIP From a FHA Loan. Ad FHA Streamline Makes Refinancing Easier Than Ever. Web For borrowers who choose the low 35 down payment option the only way to cancel the mortgage insurance premium is to pay off the loan or refinance.

Web To qualify for a refinance with most lenders youll need to have. A month ago the average rate. Ad FHA Streamline Makes Refinancing Easier Than Ever.

You may ask the lender to cancel PMI when you have paid. Web 3 Ways to Get Rid of Your PMI If you dont want to wait at least a few years until you reach the 20 equity threshold to have your PMI removed you have three. If youre not eligible for automatic removal you may have a second option for getting rid of mortgage insurance.

Web 1 day agoFor example if you take out a 30-year fixed-rate mortgage with 7000 in lender fees then roughly 19 a month in fees will be factored into the loans APR in addition to. Web You can calculate your LTV by dividing your current loan balance by the original value of your property and multiplying that by 100. In 30 months youll have.

Web 30-year fixed refinance. Web If the loan balance you currently have is less than 80 of your homes current value you should be able to request from your mortgage servicer a deletion of your mortgage. A credit score of 620 or higher At least 5 - 25 equity in your home Of course the above conditions.

Web You refinance with the exact same interest rate -- but without PMI -- for 6000 in closing costs. Web If you have a Federal Housing Administration FHA or Department of Veterans Affairs VA loan the HPA does not apply. The average 30-year fixed-refinance rate is 697 percent down 12 basis points over the last seven days.

So if you put 10 down on a. Refinance Your Mortgage Using Our Experts Tips Compare Choose The Right Rate For You. If you made a down payment of less than 10.

Youll save 200 per month this way. If you have questions about. See If You Qualify Today.

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Mortgage Insurance

April 2012 The New Fha Mortgage Insurance Premiums Mip Schedule

Many Fha Loans Now Require Mortgage Insurance For Life

How To Get Rid Of Mortgage Insurance Rocket Money

How To Get Rid Of Fha Mortgage Insurance Credible

How To Remove Pmi Get Rid Of Conventional Pmi Or Fha Mip Moreira Team Mortgage

Frb Finance And Economics Discussion Series Screen Reader Version The Influence Of Fannie And Freddie On Mortgage Loan Terms

How To Remove Pmi Get Rid Of Conventional Pmi Or Fha Mip Moreira Team Mortgage

How To Get Rid Of Mip Premiums On An Fha Loan Uhm

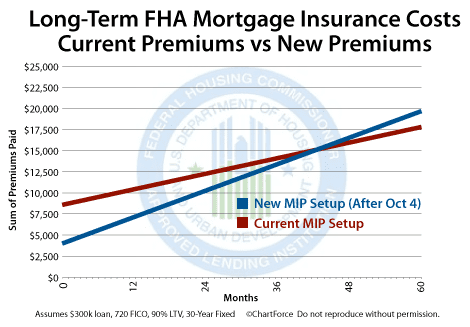

New Fha Mortgage Insurance Premiums Breakeven In 43 Months

How To Remove Pmi Get Rid Of Conventional Pmi Or Fha Mip Moreira Team Mortgage

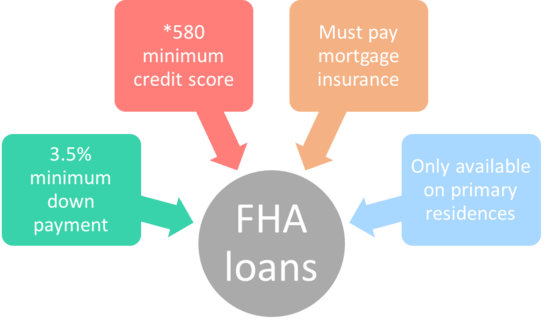

Fha Loans Everything You Need To Know

Reverse Mortgage Age Requirements For 2023

How To Remove Fha Mortgage Insurance Bankrate

How To Finally Get Rid Of Your Pmi Or Fha Mortgage Insurance Aviara Real Estate

How To Remove Fha Mortgage Insurance Total Mortgage

How To Get Rid Of Mortgage Insurance Rocket Money